| Vol.1 No.2 ← GA 6 - 7 - AA 8 - 9 - NT 10 - 11 - 12 - 13 → Vol.1 No.3 |

| General Articles |

| Vol.1, No.3, GA6 |

China's Nuclear Industry at a Turning Point |

|

Hideo KUBOTA

Vice Director, Research Institute of Tepia, Tepia Corporation Japan |

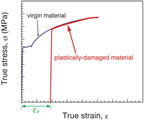

The china nuclear industry is coming at a turning point since the first Chinese nuclear power plant of Qinshan No.1 was started construction 24 years ago. At the end of year 2008, there are 11 nuclear power plants in operation in China. The total power capacity of the facilities has reached to 9068MW. It resulted in 11th position next to Sweden. Despite the nuclear power was reached to 68.4 billion KWh, it makes up only 2 % of the total electric generation in China. The thermal power takes 81 % of the total generation, in which the power by coal fuel takes for the most part and the total generation by both natural gas and oil fuel take only as small as a few percentage. In this situation, a nuclear power plant development is being accelerated. As of July 2009, China has 15 nuclear power plants currently under construction with a total capacity of 15260MW, that is more than 24000MW together with ones currently in operation. Furthermore, my research shows that China would have a plan to build 180 new nuclear power plants of 192770MW, though the progress varies widely. The construction speed of China nuclear power plant has become increasingly high since 2008. Starting with the construction of. Ningde unit 1 (PWR, 1110MW) in Fujian Province, February 2008, they continuously started constructions for five more nuclear power plants in year 2008 alone. China still holds momentum in a nuclear power plant construction even in 2009, and continues constructing new nuclear power plants. They include a Liaoning. Hongyanhe unit 3 in March, Sanmen Zhejiang April 19 which lead a construction first in the world for the third generation nuclear power plant of AP1000 (PWR, 1250MW) developed by Westinghouse, Fuqing unit 2 (PWR, 1000MW) June 17, and Fangjiashan unit 2 (PWR, 1000MW) on 17, July. Besides, Shidaowan, Rongcheng phase I (200MW), which is a demonstration reactor of HTGR in Shandong. They even said that China would start construction for approximately 7 to 9 nuclear power plants every year. Attributed to this situation, Mr. Zhang Guobao, director general of National Energy Administration charged in whole energy issues, raised the prospect that the number of nuclear power plants in China would reach to 104 eventually after 20 years. _Sites_of_Nuclear_Power_Plants_in_China.png) Upward development target toward year 2020The basis for Chinese nuclear power development is on the Medium and Long-term Plan for Nuclear Power (2005 to 2020), which was announced by the National Development and Reform Commission in November 2007. The plan defines principles and directions such as 1) to actively promote construction of a nuclear power plant, 2) to promote independent and domestic products for a nuclear power plant, 3) to adhere to the reactor line of a thermal neutron reactor – fast neutron reactor - fusion reactor, 4) to achieve self-design, self-production, self-construction and self-operations for a 1000MW PWR, 5) to reduce the cost by a competitive bidding. The plan also shows the specific targets for expansion of the nuclear power plant capacity in operation into 40GW by 2020 as well as expansion of a capacity of the ones under the construction into 18GW. When the Medium and Long-term Plan for Nuclear Power was prepared, it was projected that the total power capacity should reach to 1000GW in 2020. Based on this projection, it was calculated that 4 % of the total power capacity should be appropriate for nuclear power capacity. However, both thermal and nuclear power plant development are advancing rapidly more than expected. In China, total capacity of more than 100 GW started in operation anew during the period of 2006 and 2007. In 2008, over 90GW was added in the battle line. This resulted in the total power capacity of 792.53 GW. In comparison to the development over the past three years, a speed of development was slightly in slowdown, yet it is anticipated that the capacity increases to as much as 860 GW by the end of 2009. In this context, there is a prevailing view that the total capacity would reach to 1400GW – 1500GW by 2020. As mentioned earlier, a nuclear power plant development has been accelerating. Mr. Zhang Guobao, director general of the National Energy Administration exposed their view that 5% of the total power plant capacity is a target for the capacity of new nuclear power plants. According to a calculation based on his statement, a capacity of 70 GW to 75 GW should be at least a new target for capacity at the time of 2020. It is about 2 times of the current target. The capacity will leave France behind and will become next to U.S.A. AP1000 as a centerpiece of reactor strategy In the Medium and Long-term Plan for Nuclear Power, a thermal neutron reactor is positioned as the next one after a fast neutron reactor, but adoption of BWR is not considered so far. Among nuclear power plants in operation, they use PWR including in Qinshan phase I and phase II that is said to be self-designed, French-made PWR in Daya Bay and Lingao and Russia-made PWR (VVER) in Tianwan. They also use CANDU reactor only in Qinshan III that is made by Atomic Energy of Canada Limited (AECL) and is a heavy water reactor. So far a plan to build additional CADNU for Qinshan III is not materialized yet but they decided to initiate a study of use of thorium fuel. On July 14, 2009, AECL made an agreement with Chinese counterparties on developing thorium fuel and its demonstration, and on a study of thorium fuel development methods that is technologically and economically viable in a real scale. The Chinese counterparties in the contract include Third Qinshan Nuclear Power Company that operates Qinshan III , China North Nuclear Fuel Co. Ltd that produces heavy water reactor fuel and Nuclear Power Institute of China. In November, 2008 they also made an agreement focusing on use of reprocessed uranium for their CANDU reactor. For many nuclear power plants under construction, a CPR1000 type reactor, that is a modified version of French-made 1000MW PWR, is planned to be used. The same reactor takes 12 out of 15 reactors under construction. Although a CPR1000 type reactor is expected to be used in many power plants, a possible mainstream reactor in China is perceived to be AP1000 type eventually. In the Medium and Long-term Plan for Nuclear Power, implementation of the third generation reactors is included. These are AP1000 type reactor and EPR (PWR,1750MW) of AREVA. Only two EPRs for Taishian in Guangdong are formally planned so far, in this situation, AP1000 is being in an advantageous position. According to my survey, the number of AP1000 type reactors is counted up to as many as 54 on the list of reactor types that was announced the plans so far. These include Haiyang in Shandong considered as symbol of self-fulfillment like Sanmen, Jingyu in Jilin, Nanyang in Henan, Zhangzhou in Fujian, Taohuajiang and Taohuashan in Hunan, Fuling in Chongqing, Xianning in Hubei. Start of the first nuclear power plant construction in the inland part as earlier as 2010 In China, while all of the current nuclear power plants in operation and under construction are one-sidedly located in the coastal area, they are concretely moving towards the construction in the inland part. Vulnerability of their power supply system depending largely on coal fuel power is emerging due to suffering from heavy snow and cold weather in January 2008. The major problem was in disruption of coal supply line by the railway. Taking account of such emergency situation, the nuclear power plant needs in the inland part is growing because a nuclear fuel supply is done only at the time of the annual inspection by changing a part of fuel in the reactor. Getting behind a nuclear plant construction in the inland part is not caused by a condition of the land but by circumstances that the standardized design for construction in the inland part has not been complete, though there is the fact that the State Council has already decided a selection of AP1000 developed by Westinghouse for the nuclear power plant to be built in the inland part. Under this circumstance, they completed the overall design for a construction of AP1000 in the inland part and a design for the reactor core system and facilities. The State Nuclear Power Technology Corp. that is charged in domestication of 3rd generation reactor, have a plan to complete an initial safety evaluation report on the nuclear power plant for the inland part by the end of 2009. As a result, three projects at Xianning in Hubei, Taohuajiang in Hunan and Pengze in Jiangxi considerably will move forward extensively. Xianning in Hubei, for which China Guangdong Nuclear Power Corp. is its major stake holder, is anticipated to start the construction in the second half of 2010. In this connection, Mr. Sun Qin, former deputy director general of the National Energy Administration showed his view that AP1000 will be a leading reactor even for a nuclear power plant to be constructed anew in the coastal area. Steady development of a light water reactor as well as a new type reactorAccording to Mr. Wang Binghua, chairman of the State Nuclear Power Technology Corp., the conceptual design of a Chinese version of AP type reactor, CAP1400 (C for China) (1400MW capacity) passed in examination by a group of experts, therefore the first CAP1400 reactor is said to be possibly operational in 2017. CAP1400 is also considered for export. In addition, CAP1700 (1700MW) an upscale version of CAP1400 is in the middle of its research and development. In other than a light water reactor, Shidaowan Rongcheng Phase I power plant (200MW) a HTGR demonstration reactor is initially scheduled to start the construction in 2009 and to connect the grid in 2013. At the same site, there is a plan to expand the total capacity of HTGR to 4000MW eventually. As for a fast neutron reactor considered as important reactor next to a light water reactor by the Chinese Government, CEFR an experimental fast reactor (thermal output: 65 MW, electricity output: 20 MW) is nearly reaching the initial criticality, though construction of CEFR started in 2000 was far behind the schedule. According to the information provided by the China Institute of Atomic Energy in February 2009, CEFR is expected to reach the initial criticality point in September 2009 and will start transmitting electricity in 2010. On May 25, a work on sodium loading was complete without major problem when infusion of 260 tons of sodium into the reactor reached to a fixed level. The CEFR site was visited on July 17 by Mr. Li Ganjie, director of the National Nuclear Safety Administration and also as a vice minister of Ministry of Environment Protection, and Mr. Lin Qi a member of the Political Bureau of CPC Central Committee. Their visit hinted that the initial criticality is near to achieve. As for a prototype or demonstration reactor subsequent to the experimental reactor, a pre-feasibility study on the construction of a such reactor in Sanming, Fujian was reported at the Fast Reactor Technology Study Committee held in October, 2008. In September 2005, the then Commission of Science, Technology and Industry for National Defense revealed the strategy for a fast reactor development that is set forward in three phases in order of an experimental reactor, a prototype or demonstration reactor and a commercial reactor, and they also revealed that the prototype or demonstration reactor is planned to have a capacity of 600MW and that is scheduled to construct in 2020. Additionally, as for strengthening on research of the cutting-edge technology and basic science, a white paper, “China’s Energy Conditions and Policies” explained their policy to accelerate research and development on designing of a gas cooled fast reactor and the core technologies. Issues on standardization for a nuclear powerThe standardization is closely adhered to a reactor strategy and its domestication. It is pointed out that one of the factors to constrain a nuclear power development in China lies on insufficient standardization for a nuclear power. The Eleventh Five-Year Plan for Nuclear Industry announced in August 2006 by the then Commission of Science, Technology and Industry for National Defense exposed their concern about the situation where a solid nuclear power standardization system is not complete in China. Also the Medium and Long-term Plan for Nuclear Power makes it clear that the government controls qualification of corporations engaging in construction, operation, control and management work on a nuclear power plant. As is mentioned later, the government has been controlling the entities in this way. The then Commission of Science, Technology and Industry for National Defense reflected that the standardization for a nuclear power is not only useful to securing a nuclear power safety but also crucial to the foundation to manage solid development. In connection to this, they announced the Eleventh Five-year Plan for Establishment of Standards for Pressurized Water Reactors in September, 2007. The main portion of Chinese standards for a nuclear power reactor comprises two parts, one is a part of American standards for Qinshan Phase I (PWR 300MW) and other is a part of French standards for Qinshan II (PWR 650MW). However they found that other country’s standards did not fit in Chinese industry and its technology when they tried to adopt them. Under the circumstances, the Eleventh Five-year Plan (2006-2010) describes the target for the standards outlined as follows:

Rising abolition of restriction on entering nuclear power businessIn promoting a nuclear power, the government of China has appointed specific corporations associated with nuclear power businesses because their highest priority is to secure the safety. There are three corporations appointed by the government, these are 1) the China National Nuclear Corporation that also deals with nuclear fuel cycle business, 2) the China Guangdong Nuclear Power Corp. that does a nuclear power business mainly in Guangdong province, and 3) the China Power Investment Corporation that is one of the five biggest power companies in China. These corporations are assumed to be qualified as entity for nuclear power investment in China. They are involved in all projects under operation, construction and plan as qualified investing entity. Although a success in the way of the Chinese government is not clear, their track records in nuclear power plants look very good. 85 % is recorded as average availability factor for 2006. The track record helped achieve more than 30 % of a rate of return for the nuclear power industry comparing to about 10% for all other industries. China, that undertakes to improve the current power source composition exceedingly relying on coal, is providing various supports for the nuclear power that is environmentally clean and secures a stable power supply. One of the examples is exception to the value added-tax . The local government also is inviting actively a nuclear power plant to their land by offering good benefits for the company. Five large power corporations in China take 45 % of the total capacity. One of them, the China Power Investment Corporation has already been engaged in a nuclear power business. All other four corporations are eager to participate in the core business of the nuclear power industry. These four corporations include, Huaneng Corporation, Datang Corporation, Guodian Corpration and Huadian Corporation. One of four corporations, Huaneng Corporation earlier invested in HTGR demonstration project but due to the fact that the corporation has not acquired yet qualification as entity for nuclear power investment in China, their investment ratio for a nuclear power business is 47.5% marginally less than 50%. In the similar case that they also invested in Changjiang nuclear power plant, it still remains 49 %. Other power companies also have a business plan for a nuclear power plant, but so far they are not able to get the permission from the authority because they are not qualified yet as entity for a nuclear power business. Due to soaring coal prices and decline in power needs by slugging economy, loss of as much as 40 billion Yuan from the thermal power business is shown in their business performance 2008 for five large power corporations. Concerning with this fact, four corporations, except China Power Investment Corporation, requested Mr. Sun Qin, then deputy director general of National Energy Administration to review qualification as entity for nuclear power business in large extent. Warning against overheat on nuclear power developmentAs such movement is seen, even there is the warning against the current development being accelerated at the overly rapid pace.In April, 2009 Mr. Li Ganjie, director of the National Nuclear Safety Administration announced their views that China nuclear power industry currently faces six difficulties as described as follows:

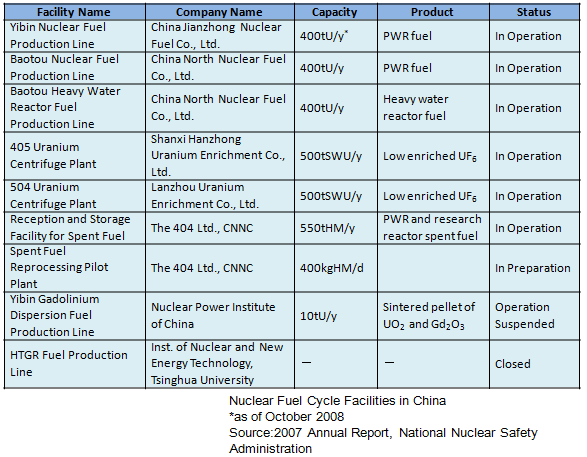

Serious shortage of human resources needed for nuclear power businessAs nuclear power development has been declining globally since 1980, interest in nuclear power in China too dropped off and some of universities then came into closing the department of nuclear engineering. Consequently many talented people left for other fields than nuclear engineering. However the situation has been changed significantly since the government has actively promoted nuclear power development. In May, Mr. Zhang Huazhu, chairman of the China Nuclear Energy Association pointed out three major factors in constraining nuclear power expansion being urged by China. These constrains are incapability of manufacturing, shortage of human resources and insufficient nuclear fuel supply. According to his information, China moved on boosting nuclear engineering education in 2005 for their expansion of nuclear power. Now the number of high education institutes for nuclear related study grew. A senior staff of the China National Nuclear Corporation (CNNC) recognizes a serious shortage of human resources associated with nuclear power. About the situation, he also disclosed the fact that the corporation hired 1,627 graduates from universities in 2008. The recruitment includes 381 graduate students from nuclear engineering study and also some graduates from science and engineering study related to nuclear power, such as radiation protection, electricity and its control. The recruitment also increased enormously at the State Nuclear Power Technology Corp. that carries on AP 1000 type reactor and domestication of the third generation reactor. Although it recruited only 50 people all together from under graduates and graduates in 2007, it recruited as many as 530 people in 2008. It is expected to increasingly recruit 1,200 people in 2009. Not limited to both corporations, there is still much demand for human resources from other nuclear related corporations in China. According to the State Administration of Science, Technology and Industry for National Defense, it is projected that the demand for graduates from the nuclear engineering field will reach to 13,000 in the number of people required by 2020. Human resource training is on the way in collaboration with a nuclear power corporation and an university. The China National Nuclear Corporation and Tsinghua University have jointly trained the students based on their objectives since 1996. 540 graduates was turned out from the training. 332 graduates out of them were hired by subsidiaries of the corporation. The corporation has jointly carried the training in collaboration with not only Tsinghua University but also Shanghai Jiao Tong University, Xi’an Jiaotong University, and Harbin Engineering University. Progressing on domestic production of nuclear power plant equipment and componentEndeavor to produce a nuclear power plant equipment and component domestically, that is a key policy of the government of China on nuclear power development, is gradually getting in a good result. So far China was able to manufacture only a reactor pressure vessel of 300MW or 600MW class. After all, a reactor pressure vessel of 1000MW class was completed recently as the first domestic ones at the Dongfang Electric Corporation in Guangzhou on June 15, 2009 and was installed in the second unit of Lingao Phase 2 where adopted CPR1000. In this connection, the China Atomic Energy Authority noted that although the 1st unit of Hongyanhe Phase I in Liaoning started construction later than that of Lingao Phase 2, it is still the first nuclear power plant (1000MW) that adopted the reactor pressure vessel completely manufactured by Chinese domestic industries. Meanwhile on June 2 the China First Heavy Industries Corporation started manufacturing a reactor pressure vessel for AP1000 designed by U.S.A. Westinghouse which is installed for the 2nd unit of Sanmen in Zhejiang. The China First Industries also has made a contract for 6 reactor pressure vessels used for both Yangjiang and Ningde power plants. In addition to these, they have a 500 million Yuan forgings contract with the China National Nuclear Corporation for 4 reactor pressure vessels and 12 steam generators (SG). These are used for both Fangjiashan and Fuqing power plants that adopt CPR1000 as well. Incidentally, a reactor pressure vessel for Haiyang 1st unit, that adapts the same AP1000 type reactor as Sanmen 1st unit, is expected to be supplied by the Doosan Heavy Industries and Construction Co., of the Republic of Korea. The company supplies 4 SGs as well. The Sumitomo Metal Industries Ltd. of a Japanese company supplies heat exchanger tube used for SG. According to “Plan for Modifying and Promoting the Equipment Manufacturing Industry” announced in May 2009, the plan discloses a policy to promote independent producttion for CPR1000 type reactor as enhanced version of the 2nd generation type in addition to AP1000 type reactor by achieving domestic production focusing on such items as a reactor pressure vessel and SG, control rod drive mechanism, pump and valve of a nuclear-use grade, and diesel generator for emergency. Mr. Zhang Guobao, a director of the National Energy Administration admitted the fact that a cost of the domestically manufactured equipments and components is about one third lower than foreign-made ones, and on the top of the fact, the main factor in constraining a nuclear power plant construction is a lack of capability to supply resources required for the plant facility construction. Whereas he mentioned a possibility of the procurement from foreign countries, he recognized the importance of a self-sufficient supply structure because of a worldwide shortage of the supply. For increasing efficient use of the existing reactor such as long-cycle operationAs it has been 15 years since nuclear power plants of both Qinshan Phase I and Daya Bay were in operation, China is holding the attention of effective use of the existing reactors. The China Guangdong Nuclear Power Corporation has practiced 18 months cycle operation using high burn-up fuel for the 1st unit of Daya Bay. The unit recorded 487 days of consecutive operation on October 18, 2007. The corporation started a feasibility study on 18 month extended operation cycle in 1996. With permission of National Nuclear Safety Administration, the corporation changed the current operation cycle from 12 to 18 months in December 2001. On the successful outcome of 1st unit of Daya Bay, the corporation has also a plan to take it in Lingao nuclear power plant. In case of Lingao Phase II nuclear power plant that started on the construction 2005, The plant adopts about 15 important technology improvements such as digital instrumentation and control, a 18 month cycle operation, and so on. In total, 40 items for technical improvement are included in the plan. In Qinshan Phase I, a plan to make the operation life longer is materializing. The lifetime of the power plant on the design basis, that Shanghai Nuclear Energy Research & Design Institute took charge of the whole architectural design, is set to be 30 years. However Quinshan Nuclear Power Corporation disclosed in 2007 a joint study of an acceptable methodology to manage the lifetime of additional 20 to 40 years, which is carried out in cooperation with the Institute and the Nuclear Power Institute of China. In connection to this, the power plant stopped operation on October 28, 2007 to carryout the 10th fuel exchange and maintenance works. During the period of the stop, the largest scale modification was made ever since the commercial opersation in 1994. The power plant resumed the operation in January 2008 after completion of extensive modification works on the upper head and digitization of protection system. Staying on a recycle courseChina confirmed their decision in the earlier time to recycle plutonium for expansion of nuclear power in the future by reprocessing the spent fuel. This policy has never been changed since then. It is also reconfirmed in the Medium and Long-term Plan for Nuclear Power to stay on a recycle course. It is specified clearly in the Eleventh Five-year Plan for Nuclear Industry that the production capacity of each process for the nuclear fuel cycle should be increased the production capacity 4 to 6 times in comparison with the current production level. The plan also disclosed three directions for uranium resources 1) to increase the domestic production, 2) to actively advance the mine development in foreign countries, and 3) to promote international trade. The current natural uranium production capacity in China is approximated to be 800 tons U per year, whereas the required amount of natural uranium to spend is estimated to be 1600 tons U per year. Consequently, half of the required amount turns out to be imported. In this connection, the required amount of natural uranium is expected to be 10,000 ton U in the case where the total nuclear power plant capacity is presumed on 4000MW or to be 18,750 ton U for the capacity of 7500MW at the time of 2020. Emergence of an idea of uranium enrichment center in AsiaUsing the Russian centrifuge separation technology, the total capacity of uranium enrichment in China reached to 1000 tons SWU (separative work unit) in 2007. In addition, China in cooperation with Russia now plans to construct an enrichment plant capable of producing 500 tons SWU. Whereas a demand for uranium enrichment in China is expected to expand to 2500 tons SWU by 2010 and to 7000 tons SWU by 2020 in according to the current Medium and Long-term Plan for Nuclear Power. A senior staff of China National Nuclear Corporation, that is engaged in the nuclear fuel recycle business, disclosed China’s intention that aims to be a center of uranium enrichment in Asia in order to increase a capacity of uranium enrichment more than currently needed and to supply the excessive portion to other countries. Also he signified their intension to construct continuously and run new enrichment plants during the period from 2010 to 2020. Regarding a nuclear fuel production, 400 tons U for PWR is in production in Yibin, Sichuan and also a production facility of a 400 tons U capacity is under construction in Baotou, Inner Mongolia, where a CANDU fuel production line is also in operation. Moreover in Baotou, they started construction of a fuel production line for HTGR April 2009, and also have a plan for the fuel production for AP1000 type reactor. Table 1 Nuclear Fuel Cycle Facilities in China

Ready to submit a proposal for a commercial reprocessing plantIn the Medium and Long-term Plan for Nuclear Power, it clearly spells out a necessity to raise a spent reprocessing fund for the reprocess as important part of nuclear fuel recycling. Accordingly, the plan laid out the direction to start the related study during the 11th Five Year period and to target for carrying out the scheme before 2010. The plan also includes establishing a corporation specialized in the reprocessing. In China, the construction of a reprocessing pilot plant (400 kg HM a daily reprocessing capacity) started in Lanzhou, Gansu 1998. Now it appears to be in a hot testing stage. The plant in the next stage will increase the annual capacity up to 100 tons. In this regard, the plant accepted a spent nuclear fuel from Daya Bay nuclear power plant in September 2003. In the Eleventh Five-year Plan for Nuclear Industry, the plan outlined the direction on a commercial reprocessing plant (a capacity of 800 tons HM) following the pilot plant, that is to select a construction site and to decide the technological approach in accordance with the criteria defined based on findings from the preparative works and the study. A commercial reprocessing plant has been decided to be constructed in Gansu province. They already completed a research work, a preliminary feasibility study and a proposal. The proposal is considered for submitting to the National Development and Reform Commission in 2009. In regard to radioactive waste management, the Radioactive Pollution Control Law regulates a shallow land disposal for low and medium level radioactive waste, and geological disposal for high level radioactive waste and alpha emitted radioactive solid waste. The plan also spelled out for establishing an organization that is specialized in managing storages and treatments for radioactive waste. Moreover, in the Medium and Long-term Plan for Nuclear Power, the plan targets on constructing an underground experimental laboratory for the final disposal of high-level radioactive waste as well as on completing the final plan for high-level radioactive waste before 2020. Defining respective policies is on the detailed schedule As China is approaching the end of the 11th Five Year Plan in 2010, they are more active on preparing the 12th Five Year Plan (2011-2015) for each sector. In the power related sector, they appear to consider the view that the current nuclear policy is practiced in a mode of “Active Promotion” and it should be transformed into “Accelerated Development”. The 12th Five Year Plan for Nuclear Fuel Industry is expected to start composing by the end of this year. In addition, they will start soon establishing the Natural Uranium Reserve System Plan and the Nuclear Power personnel Qualification Rules. Although the new target for nuclear power is also described in the Plan for Promoting the New Energy to be published soon, the most interest would be in revision of the Medium and Long-term Plan for Nuclear Power published most likely in 2009 or 2010. What else in the plan would be revised is interesting, though it is believed that the nuclear power target in 2020 is surely revised to increase. As mentioned earlier, there is such of circumstance as it does not make yet a clear rule for qualification as entity for nuclear power investment. In this regard, the rule appears to be made and is now in the State Council’s hand to approve. A binding nuclear power control regulation is an important clue to find the China’s nuclear development direction. The regulation is expected to include the following five rules for 1)design and construction of a nuclear power plant, 2) research and development on science and technology, 3) equipment and component production, 4) qualification as the business entity, 5) nuclear safety. |