| Vol.3 No.2 |

| General Articles |

| Vol.3, No.3, GA18 |

Current Status and Outlook of the Wind Energy in China |

|

HIDEO KUBOTA,

Tepia Corporation Japan CO.,Ltd

|

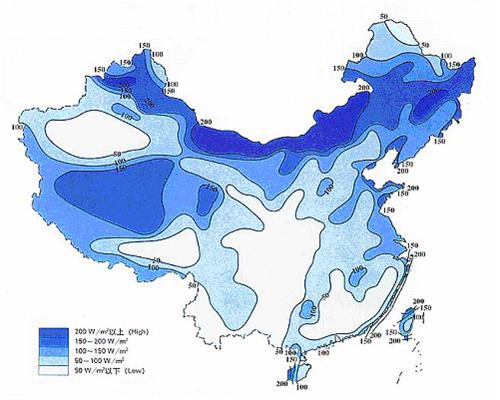

1. China’s installed wind power capacity reaching 41.8 GW in 2010China has abundant wind power resources.According to statistics conducted by the Chinese Academy of Meteorological Science at 900 weather stations nationwide, China has about 1000GW of wind power resources . Among those resources, onshore wind power was estimated at 253GW, which is distributed among Northern areas such as Inner Mongolia, Gansu, Xinjiang-Uygur, Heilongjiang, Jilin, Liaoning, Qinghai, Tibet, and Hebei. Whereas, offshore wind power capacity is estimated to be about 750GW, which is distributed in Shandong, ,Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, Guangxi, and Hainan. Of these above, the most abundant regions are divided into four groups, namely southeast coastal and islands area, Inner Mongolia and north Gansu, Heilongjiang, east Jilin and Liaodong coastal area, and Qinghai , Tibet Plateau.

Figure1 Wind Energy Density in China(W/m2)

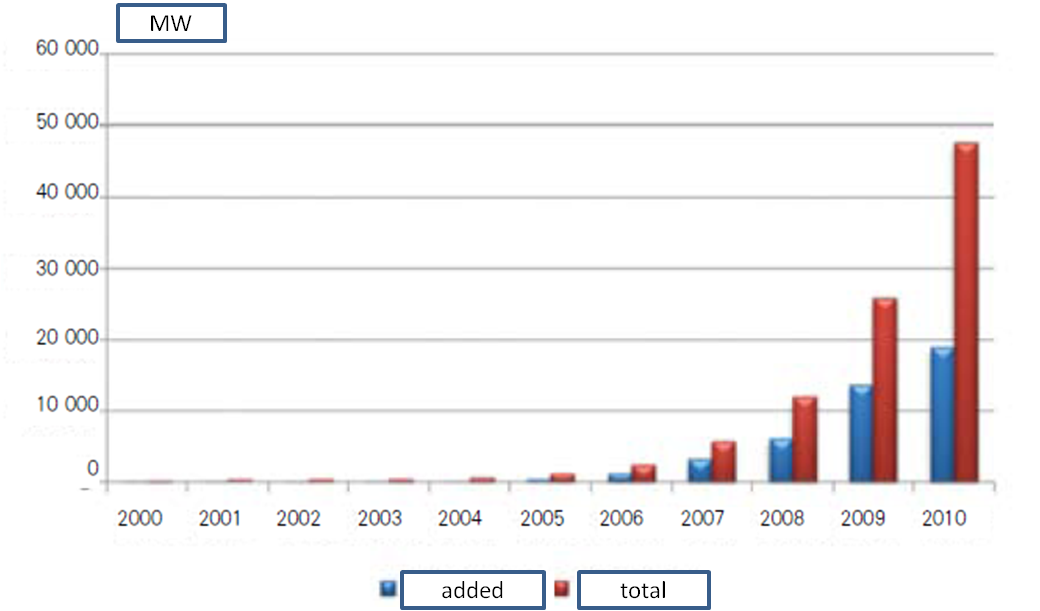

(Source: China Meteorological Administration) The political encouragement of the Chinese government has made its wind power industry advance rapidly in the period of “The 11th Five-year plan” term (2006-2010). Chinese wind power generating capacity was only 342MW in the end of 2000, passed 1000MW in 2005, rose at almost double after 2006, and reached 44730MW at the end of 2010[1]. However, according to State Electricity Regulatory Commission, only 29,580MW of Chinese wind power capacity was connected to the grid. China’s total power generatiing capacity was 966.41GW at the end of 2010. The breakdown is : thermal power 709.67GW, hydro power 216.06GW, wind power 29580MW[2], and nuclear power 10820MW.

Figure2 China’s Wind Power Capacity, 2000--2010

(Source: China Wind Power Outlook 2011(June 2011))

Figure3 Grid-connected Wind Power Capacity, 2006--2010

(Source: State Electricity Regulatory Commission) 2. Aiming at 70GW of the new wind power by 2015.“The Mid. and Long Term Development Plan for Renewable Energy” was announced by the Chinese government in 2007. According to the Plan, China had set targets of wind power 5GW in 2010 and 30GWin 2020, respectively.

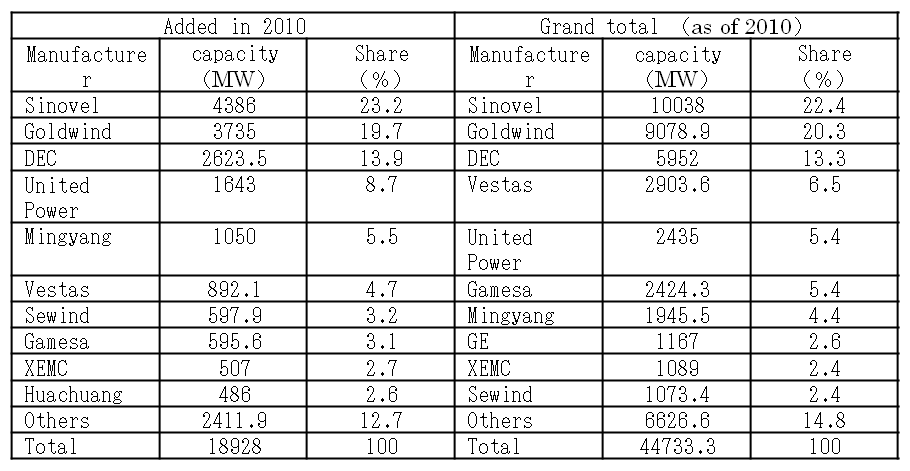

Also, “the 11th Five Year Plan for Renewable Energy”, had stated the goal reaching 1GW by 2010. “The 12th Five Year Plan” started in 2011, so it is still an undisclosed renewable energy development plan, but “The 12th Five Year Plan Outline ” was announced in March 2011, which expected to construct new wind power capacity with more than 70GW between 2011 and 2015. The state Council Standing Committee , convened by Premier Wen Jiabao in November 25th 2009, has mandate a CO2 emission reduction per unit of GDP by 40-45%, which was incorporated in “The mid. Long term Plan of Economic and Social Development” as the valid guideline. And Chinese government decided on its policy to raise the share of non-fossil energy(renewable energy plus nuclear power) of primary energy consumption from 7.1% in 2009 to about 15% in 2020. In “The 12th Five-Year Plan Outline ”, Chinese government has set the goal of non-fossil energy share to raise 11.4% by 2015. 3. The age of “the scaling- up and localization started in 2003First of all, the small-scale wind farms such as 10kW or less were built in the Jilin Province and Xinjiang. In the late 1970s, the first wind power generating unit with capacities of 18kW was built in the country. In 1983, three wind power generating units with capacities of 55kW were imported for developing domestic technology. After that, in 1986, China built its first grid-connected wind unit in Rongcheng, Shandong Province. The unit was the “ V15-55/11”,which were manufactured by Vestas in Denmark. This period, from 1986 to 1993, is referred to as the initial demonstration period. Chinese government proposed a wind power localization program in 1994, through which capacities of 50kW,120kW,200kW,300kW,500kW, have been constructed. The period from 1994 to 2003 was called the industrialization period. The National Development and Reform commission started the Wind Power Concession Bidding projects in 2003. In this project, investors are selected through competitive bidding. They aim to get the seat of the project contractors. The selected contractors developed the construction rules, such as scale, technical parameters, construction condition, electricity sales policy,and so on. Since then, the total capacity of competitive bidding was reached 8800MW in 2007. The guidelines of the bidding project are as follows, - Investors will be selected by public bidding : the successful bidder will obtain the contract of constructing the wind power facility. - The localization rate of wind power equipment used in the project is determined . - The technological parameters ,startup time and management term of the projects are determined - The selling price of the projects should be set based on the bidding price for the first 30000 operating hours, and after that is for market price. - The grid companies should purchase all generating electricity of the project. And also, the difference between the wind power price and the the conventional power prices of the grid companies will be shared by the grid companies. All electricity produced in the program would be purchased by the grid companies on the government commitment, and the differences would be shared by electricity users under “the difference share policy”. The bidding projects were basically operated by National Development and Reform Commission. The projects larger than 50000kW are authorized under a concession bidding process managed by the Commission. Successful bidders were evaluated, and approved by commission. The project smaller than 50,000 kW, on the other hand , was managed by its local energy administrator. A lot of developers used to set the projects with capacity of 49,500kW for participation in “Non-concession program” that was managed by the local government. That was not only because that was easy to pass their screening process, but also the local government had a responsibility for deciding the sales power prices. The Chinese government has been strongly supporting the development of wind power . They increased the subsidy of the national finance to the development of wind power from 138 million yuan in 2002 to 2377 million yuan in 2008. Despite the support, wind power companies have a small benefit because wind power generation has unstable characteristics as well as there are restrictions such as technical and management capabilities. 3.Chinese wind power equipment production capability exceed its demands.According to Xinhuanet on Jan.14th, 2010, New Energy Department of National Energy Bureau announced to withdraw the rule which required the localization rate of over 70 % to construct the wind power stations . Table1 China’s Top Ten Wind Turbine Manufacturers

(Source: Chinese Wind Energy Association(March, 2011))

4. Massive grid disconnection accidents have occurred.The dire need for a solution to the wind power grid connection problem behind the wind farm accidents which occurred in 2011. The accidents raised concerns about grid safety with the introduction of large scale renewable energy. The grid disconnection accident occurred at the wind power farm in Jiuquan city of Gansu Province. The cable head of the 35B4 switch cell C of the farm unit broke down, and it triggered an insulation breakdown, which caused a three-phase short-circuit on 24 Feb., Triggered this accident, 274 units of the farm were disconnected from the grid, because their units have not LVRT(Low Voltage Ride-Through) capability. Because of the absence of StaticVar Compensator at the farm, the voltage spiked rapidly, and 300 units had to be disconnected from grids by voltage protection system. Also 24 units got disconnected because of the frequency protection system. As a result, there were 596 units disconnected. The total wind power capacity disconnected was 840MW, which accounted for 54.4% of total wind capacity in Jiuquan city. The accident has brought the frequency drop from 50.034HZ to 49.854HZ . LVRT capability allows the power grid time to self adjust during temporary faults by maintaining uninterrupted grid connection, thus increasing power grid stability. In Germany and Spain, which relied significantly on renewable energy, required not only LVRT but also DVS(Dynamic Voltage Support), which can support system voltage to output certain power if a voltage drop occurs. China had not yet set clear requirements for LVRT then. Quite a few of the Chinese wind power stations have installed LVRT systems There were accident at the wind farms in Gunsu Province and Hebei Provine on Apr, 17th because of the absence of LVRT capability. About 700 units totaling 1000MW had disconnected in Gansu, and 644 units totaling 854MW also disconnected,. More accidents happened in China on Apr,3rd,24th, and 25th. Of those accidents, the accident occurred on Apr,25th saw 1278 disconnected units, which accounted for around for 78% of the total units in Jiuquan. In consideration of the massive grid disconnection accidents, the State Electricity Regulatory Commission announced on Apr, 27, 2011, “Notice on strengthening of safety and control of wind power plant, and limiting the big disconnection accident” to two Chinese big transmission companies, namely the State Grid Corporation of China and the China Southern Power Grid, and five big electric producers, such as Huaneng, Datang, Huadian, Guodian, China Power Investment. The notice explained that the accidents on Feburary and Apr,17th were related to the 35kV feeder breakdown to lead voltage drop. A lot of wind power units in the area installed neither an LVRT system, nor the automatic switching capability of StaticVar Compensator condenser . These were the reason for the accidents. As a measurement to prevent grid disconnection accidents , all wind power unitis are required to install an LVRT system. And also, the wind power units, that has already LVRT capability, are required to upgrade when necessary. In such cases, the wind power generators needs to work more closely with wind power manufacturers. Of cource, all new units to be constructed are required to have LVRT capability. The China Electric Power Research Institute estimated that there are a number of units requiring LRVT capability on a nation wide scale. Goldwind says, it costs about 100000 yuan to upgrade a single unit, but in some cases, it costs 500000 yuan per unit[5]. Sinovel, which is the top manufacturing company accounting for one-fourth of the Chinese wind power market , said the largest and most powerful unit “SL6000”with a capacity of 6MW, has completed at industrial base in Jiangsu on May, 30th ,2011. The “SL6000”, the company owns intellectual property, can be used both on-shore and off-shore. Moreover, the system has already adapted an LVRT, so it can meet any demands from domestic and overseas needs. The Chinese wind power manufacturers’ export result in 2009 as follows: Shinovel:10units for India(total 15MW) Goldwind:3units for the US(total 4.5MW) Sewind:total 5units (3units for the UK, 2units for Thailand) New Unite: total 2units (1unit for the US, 1unit for Thailand) However, the total exported units in 2010 has dropped to 13units( 15.55MW). 5. Chinese Wind Power Capacity to reach 1000GW in 2050.

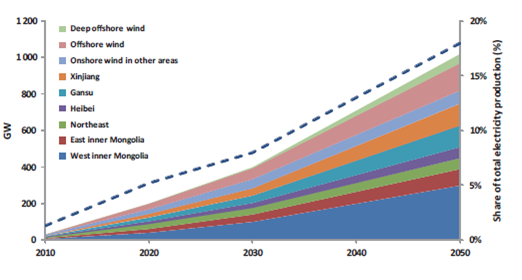

International Energy Agency (IEA) and Energy Research Institute of National Development and Reform Commission of China issued the “Technology Roadmap: China Wind Energy Development Roadmap 2050”.in October 2011

It showed that the wind power will has a key role in low carbon development strategy, which was proposed by the Chinese government. They expected some15GW of wind power capacity was installed each year up to 2010.

If all goes according to the Roadmap, wind power capacity reaches 200GW in 2010 that account for 5% of total electricity produced. Also it mentioned, between 2020-2030, some 20GW of wind power capacities will be installed every year reaching 400GW in 2030. It will account for 15% of all installed power capacity, for 8.4% of total electricity . From then, on shore and off shore installation of 30GW is anticipated, and the capacity would reach 1000 GW by 2050. It could provide 17% of China’s electricity output . If these plans are brought to fruition, the coal consumption could be decreased by 130 million tce in 2020, 260 million tce in 2030, and by 2050, 660million tce of coal comsumption would be avoided. This will reduce annual CO2 equivalent emissions by 0.3 gigatonnes in 2020, 0.6 gigatonnes in 2030 and 1.5 gigatonnes in 2050. Moreover, employment in 2020 resulting from wind power is expected to be around 1.5jobs per MW. With efficiencies and economies of scale, this is expected to fall to some 1.1 jobs per MW in 2020, and 0.8jobs per MW in 2050. This Roadmap expects the wind industry to employ some 360,000 individuals in 2020, rising to 600000 in 2030 and nearly 750000 in 2050.

Figure4 Targeted installed capacity and electricity share of wind power in China,

2010--2050 (Source:Technology Roadmap: China Wind Energy Development Roadmap 2050(International Energy Agency, National Development and Reform Commission’s Energy Research Institute, Oct. 2011) ) References[1]“ China Wind Power Outlook 2010”(Oct. 2010), “China Wind Power Outlook 2011”(June, 2011)

[2]http://www.gov.cn/gzdt/2011-09/01/content_1938552.htm [3]http://www.china5e.com/show.php?contentid=198813 [4]http://www.p5w.net/stock/news/zonghe/200709/t1212434.htm [5]http://www.china5e.com/show.php?contentid=177188 |